modified business tax return instructions

You must file a written statement with your original income tax return for the first tax year in which two or more activities are originally grouped into a single activity. Right click on the form icon then select SAVE TARGET.

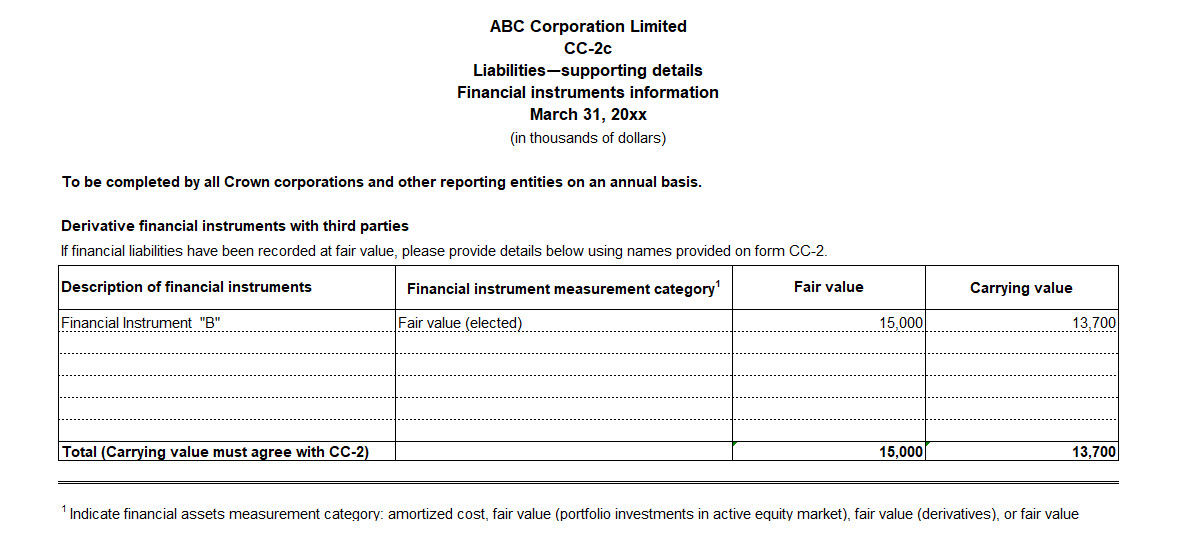

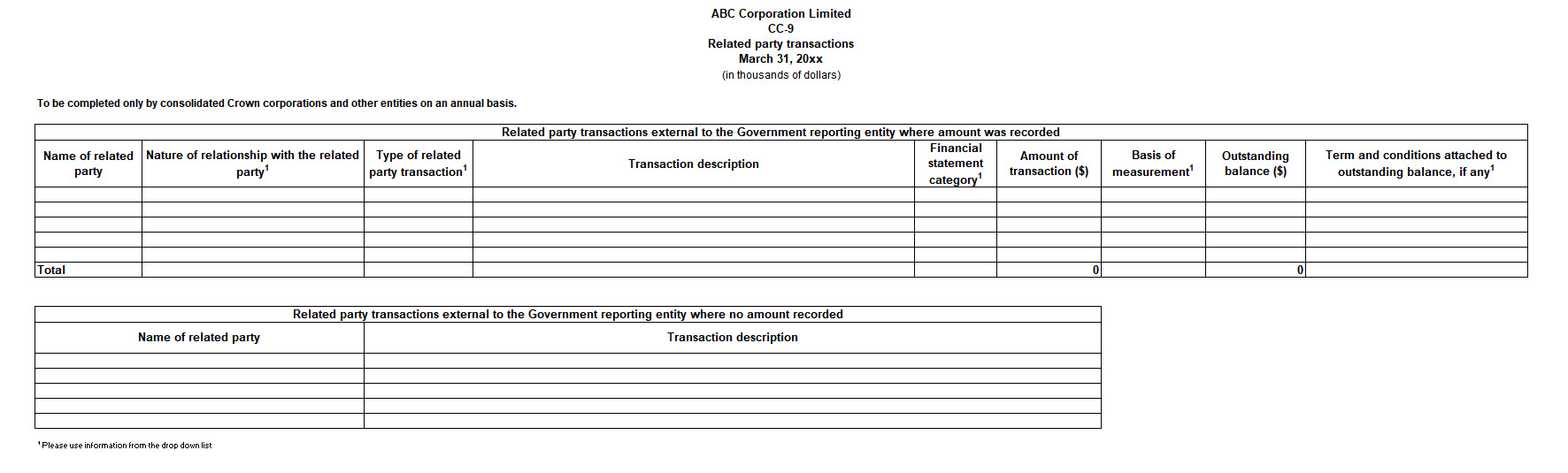

Reporting Instructions For Crown Corporations And Other Reporting Entities

The amended return must include any resulting adjustments to taxable.

. If you are using Chrome Firefox or Safari do NOT open tax forms directly from your browser. Include a copy of the original return 2. Line-through the original figures in black ink.

Signature Date 1 to 10 11 to 15 16 to 20 21 to 30 31 15. The Nevada Modified Business Return is an easy form to complete. MODIFIED BUSINESS TAX RETURN 1.

PREVIOUS DEBITS Outstanding liabilities AMOUNT. Modified Business Tax. BUSINESS TAX MINING RETURN This form is a universal form that will calculate tax interest and penalty for the appropriate periods if used on-line.

INSTRUCTIONS - MODIFIED BUSINESS TAX RETURN - FINANCIAL BUSINESSES ONLY General Businesses need to use the form developed specifically for them TXR-02005 Line 1. Total gross wages are the total amount of all gross wages and. On the S portions Form 8960 worksheet enter the S portions net investment income on line 7 of the trusts Form 8960 and combine line 19a of the Form 8960 worksheet.

Quick guide on how to complete nevada modified business tax return form. If APTC was paid on your behalf or if APTC was not paid on your behalf but you wish to take the. Write the word AMENDED in black ink in the upper right-hand corner of the return.

INSTRUCTIONS - MODIFIED BUSINESS TAX RETURN - GENERAL BUSINESSES ONLY Financial Institutions need to use the form developed specifically for them TXR-02104 IF YOU. The modified business tax covers total gross wages less employee health care benefits paid by the employer. BUSINESS TAX GENERAL BUSINESS.

Gross wages payments made and individual employee. The amended return must be filed within the time prescribed by law for the applicable tax year. It requires data and information you should have on-hand.

Employers who pay employees in Nevada must register with the NV Department of Employment Training and Rehabilitation DETR for an Employer Account. INSTRUCTIONS - MODIFIED BUSINESS TAX RETURN - GENERAL BUSINESSES ONLY - Use this form only for the quarterly filing period beginning July 1 2009 Financial Institutions need to. Endobj 3 0 obj Type Page MediaBox 0 0 612 792 Parent 1 0 R Resources ProcSet PDF Text ColorSpace 6 0 R ExtGState 9 0 R Font 11 0 R Contents 33 0 R endobj 4 0 obj.

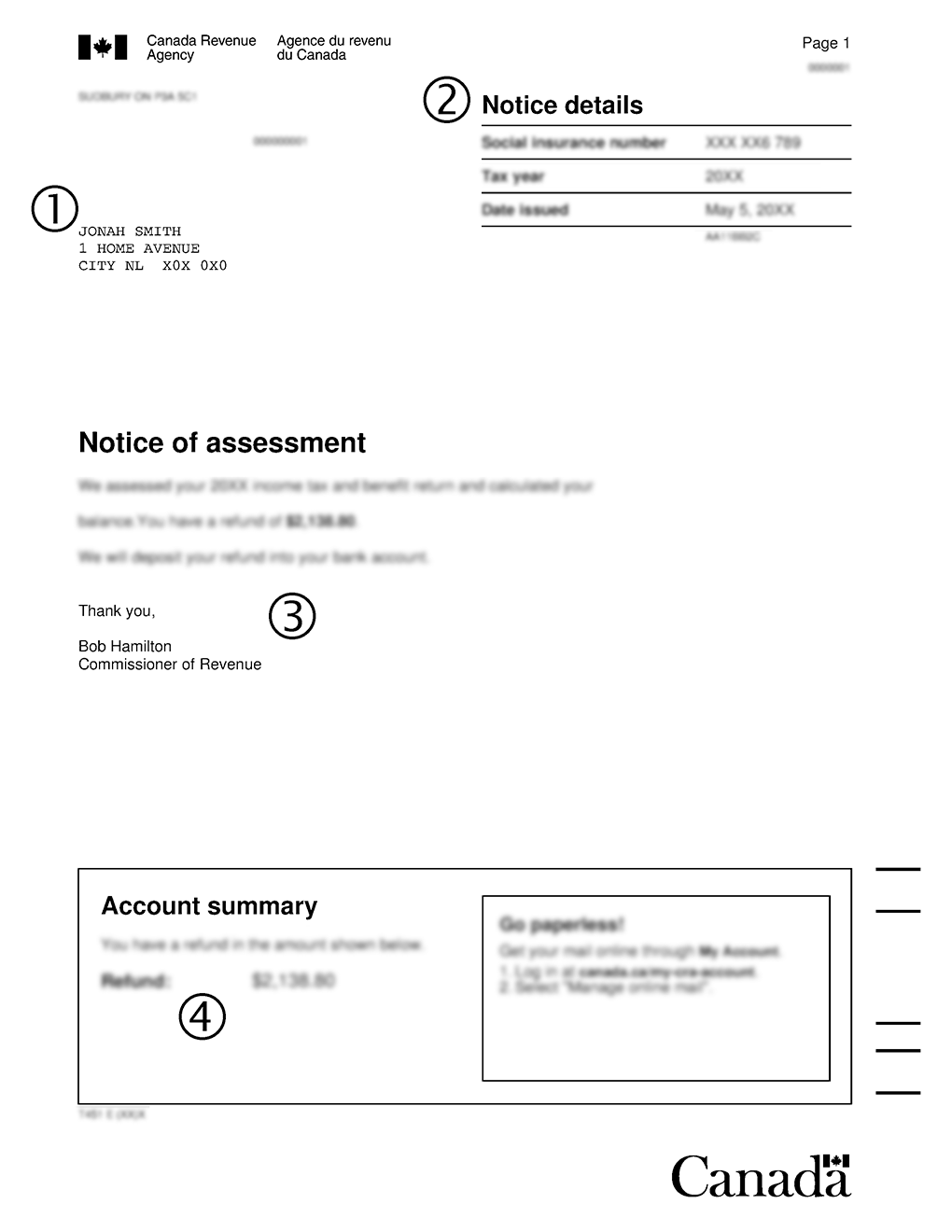

Completing A Basic Tax Return Learn About Your Taxes Canada Ca

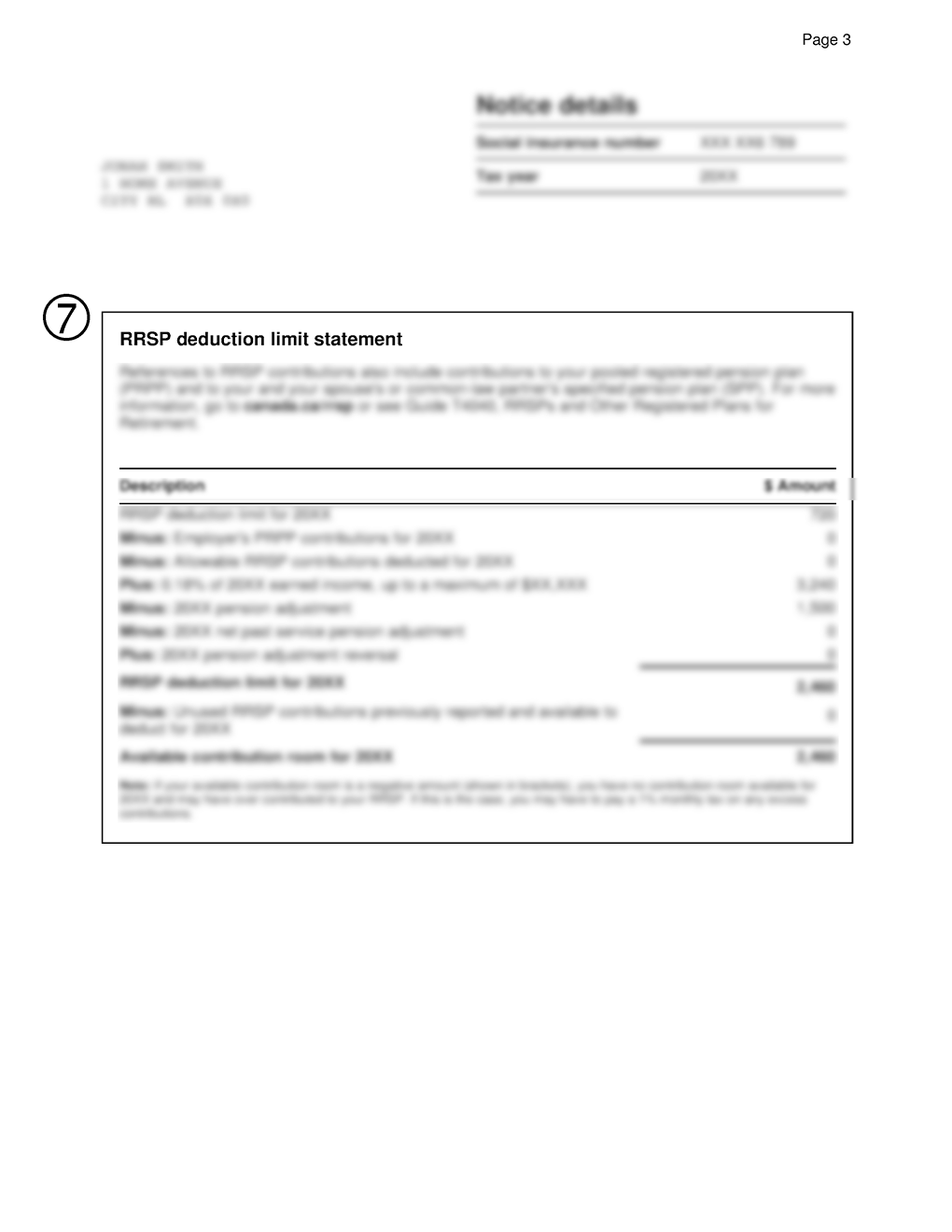

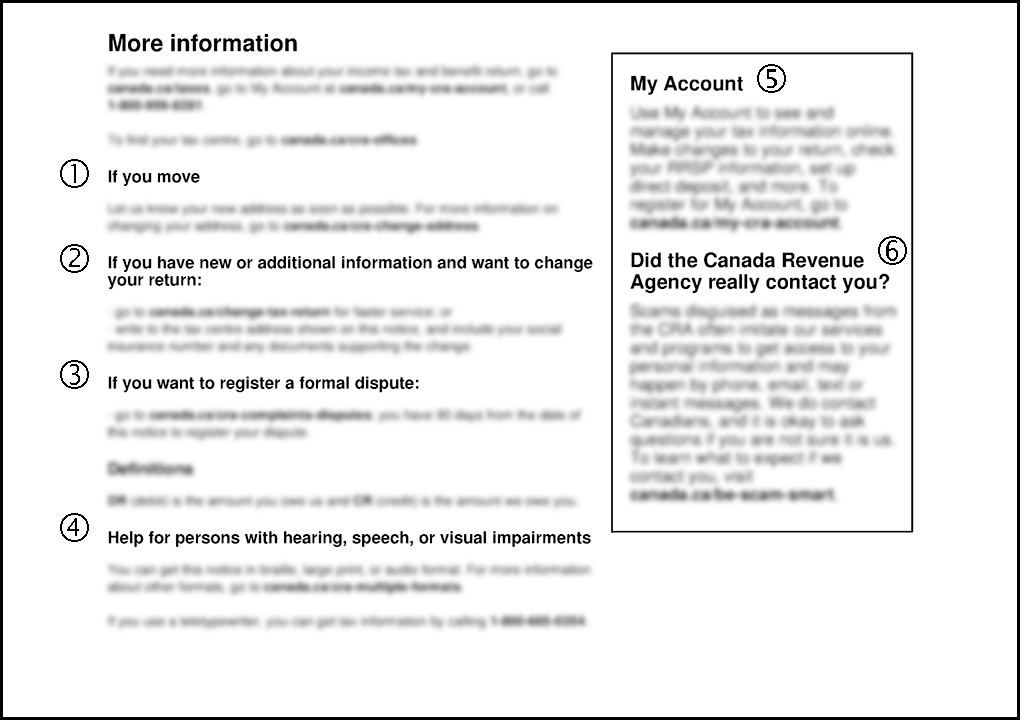

After Sending Us Your Tax Return Learn About Your Taxes Canada Ca

Reporting Instructions For Crown Corporations And Other Reporting Entities

After Sending Us Your Tax Return Learn About Your Taxes Canada Ca

After Sending Us Your Tax Return Learn About Your Taxes Canada Ca

Reporting Instructions For Crown Corporations And Other Reporting Entities

Tax Planning Strategies Tips Steps Resources For Planning Maryville Online

After Sending Us Your Tax Return Learn About Your Taxes Canada Ca

Completing A Basic Tax Return Learn About Your Taxes Canada Ca

Microsoft Dynamics Gp Year End Update 2021 Payables Management Form Changes Microsoft Dynamics Gp Community